Renewable energy development in the United States has grown significantly in recent years. That development is driven by governmental requirements, including renewable portfolio standards; financial incentives, including renewable energy tax credits and the Inflation Reduction Act (IRA) of 2022; and corporate demand for clean-energy alternatives.

Total annual U.S. electric generation from wind energy increased from approximately 6 billion kWh in 2000 to approximately 380 billion kWh in 2021. Most renewable energy in the U.S. comes from land-based wind and photovoltaic solar installations, and in 2022, land-based wind turbines provided more than 10 percent of total U.S. utility-scale electricity generation.

The offshore wind industry in the U.S. has been slower to develop, despite being well-established in Europe and taking off quickly in China. In 2021, President Joe Biden announced a goal of developing 30 GW of offshore wind generating capacity by 2030, but the nascent U.S. offshore wind energy industry has a long way to go in order to reach that ambitious target.

U.S. Offshore Projects

Currently, there are seven wind turbines spinning off the U.S. coast with a combined generating capacity of 42 MW: five of which comprise the 30-MW Block Island Wind Farm and two of which make up Dominion Energy’s 12-MW Coastal Virginia Off-shore Wind Pilot Project. According to the U.S. Department of Energy’s (DOE) Offshore Wind Market Report for 2023, which covers U.S. projects in various stages of development through May 31, 2023, another 932 MW of offshore wind generation is under construction.

This total includes the 132-MW South Fork Wind Project off the coast of New York and the 800-MW Vineyard Wind Project, located approximately 14 nautical miles south of Nantucket and Martha’s Vineyard, off the coast of Massachusetts. Vineyard Wind began construction in late 2021 after years of permitting delays and legal challenges from coastal residents and the fishing industry. The project developers announced installation of the first of the project’s 62 planned turbines in October 2023. The same DOE report cites another nearly 21,000 MW of offshore wind projects undergoing permitting and more than 30,000 MW in pre-permitting stages of development, including planning and site control.

In late September, the Bureau of Ocean Energy Management (BOEM) approved the Construction and Operations Plan for Ocean Wind 1, a project that Danish wind developer Orsted planned to construct approximately 15 miles off the coast of New Jersey. On October 17, 2023, the County of Cape May, New Jersey, together with several business with interests in the tourism and fishing industries, filed suit in federal district court challenging the adequacy of BOEM’s environmental review of the project, alleging that development of the project will cause significant adverse impacts to the endangered North Atlantic right whale and other marine mammals, as well as the local tourism and fishing industries, and other harms. Then, in late October, Orsted announced it was ceasing development of Ocean Wind 1, as well as Ocean Wind 2, another similarly-sized project that was planned off the New Jersey coast, citing rising interest rates and rising inflation.

Development Challenges

There are many reasons for the slow development of the offshore wind industry in the U.S.

First, the energy market in the U.S. is much different from the markets in Europe and Asia where the offshore wind industry has been quicker to develop, with less expensive fossil-fuel-fired generation and more onshore wind and solar options available, as well as additional legal requirements, environmental review obligations, and opportunities for legal challenge by opponents of an offshore wind project.

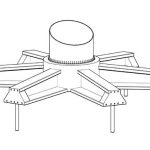

Second, installation and maintenance of offshore wind projects requires highly specialized equipment and labor that are not readily available in the U.S., making these projects expensive to construct and operate. Further complicating matters, under the Jones Act, only U.S.-flagged ships that were built in the U.S. and crewed by Americans may move cargo between U.S. ports. This precludes developers from bringing in large, specialized ships and crews from Europe and Asia to assemble the massive turbines on the outer continental shelf, and there are currently few Jones Act compliant vessels capable of doing that work.

Projects that have been built and are under construction have been forced to develop work-arounds, which include transporting project equipment and components out to specialized assembly vessels brought in from outside the U.S.

Third, given the nascent state of offshore generation, there is little existing transmission infrastructure in the U.S. to get energy to shore and onto the electric grid. As a result, the cost of transmission – including installation of hundreds of miles of undersea cables – is added to the already-high cost of project development.

Fourth, as with Vineyard Winds and Ocean Wind 1, offshore wind projects often face legal challenges from coastal residents who do not want wind turbines in their viewshed and from the fishing industry. Recent challenges have also included claims that development of offshore wind projects harm whales and other marine life.

Path to Construction

The costs associated with construction, combined with the availability of relatively inexpensive and abundant energy available from other sources, often threaten the economic viability of off-shore wind projects. In recent months, there have been reports of offshore wind developers considering writing off previous investments due to supply chain problems and other economic issues and seeking to cancel power purchase agreements that were negotiated when economic conditions appeared more favorable. That BOEM held a lease sale in August for development opportunities in the Gulf of Mexico and received no bids for two of the three available lease areas provides more than anecdotal support to these reports.

Despite the headwinds facing America’s incipient offshore wind industry, there are reasons for hope. The Biden Administration stands by its target of developing 30 GW of offshore wind capacity by 2030, and significant progress may be made even if industry falls short of that goal. Earlier this year, BOEM issued a proposed rule that would update and modernize the regulations governing offshore wind energy development. According to the most recent Unified Agenda of Regulatory and Deregulatory Actions, a final rule is expected in the first quarter of 2024. Additionally, the IRA offers energy investment tax credits for investment in offshore wind projects that begin construction by January 1, 2026, which are expected to accelerate development efforts over the next several years.

The International Energy Agency projects increased growth in offshore wind development globally over the next several years, with the United States becoming a sizeable market by the end of 2027. While current legal and economic conditions in the United States are less favorable to the development of the offshore wind industry than in other parts of the world, many remain cautiously optimistic.