Green infrastructure developer Cerulean Winds has revealed an ambitious plan to accelerate decarbonization of oil and gas assets through an integrated 200-turbine floating wind and hydrogen development that would shift the dial on emissions targets and create significant jobs.

The £10 billion proposed green infrastructure plan would have the capacity to abate 20 million metric tons of CO2 through simultaneous North Sea projects West of Shetland and in the Central North Sea.

The venture is now calling on U.K. and Scottish governments to make an exceptional case to deliver an extraordinary outcome for the economy and the environment. A formal request for seabed leases has been submitted to Marine Scotland.

Cerulean Winds is led by serial entrepreneurs Dan Jackson and Mark Dixon, who have more than 25 years’ experience working together on large-scale offshore infrastructure developments in the oil and gas industry. They believe the risk of not moving quickly on basin wide decarbonization would wholly undermine the objectives set out in the recent North Sea Transition Deal.

Cerulean Winds is led by serial entrepreneurs Dan Jackson and Mark Dixon, who have more than 25 years’ experience working together on large-scale offshore infrastructure developments in the oil and gas industry. They believe the risk of not moving quickly on basin wide decarbonization would wholly undermine the objectives set out in the recent North Sea Transition Deal.

“The U.K. is progressing the energy transition, but a sense of urgency and joined-up approach is required to enable rapid decarbonization of oil and gas assets or there is a risk of earlier decommissioning and significant job losses,” said Jackson, founding director of Cerulean Winds. “Emissions are quite rightly no longer acceptable, but with emissions penalties and taxes coming, the U.K. oil and gas industry’s role in homegrown energy security during the transition could be threatened unless current decarbonization efforts can be greatly speeded up. The consequences of not moving quickly enough will be catastrophic for the economy and the environment.”

The Cerulean leadership has Tier 1 contractors in place to deliver the UKCS backbone development and has engaged the financial markets for a fully funded infrastructure construct.

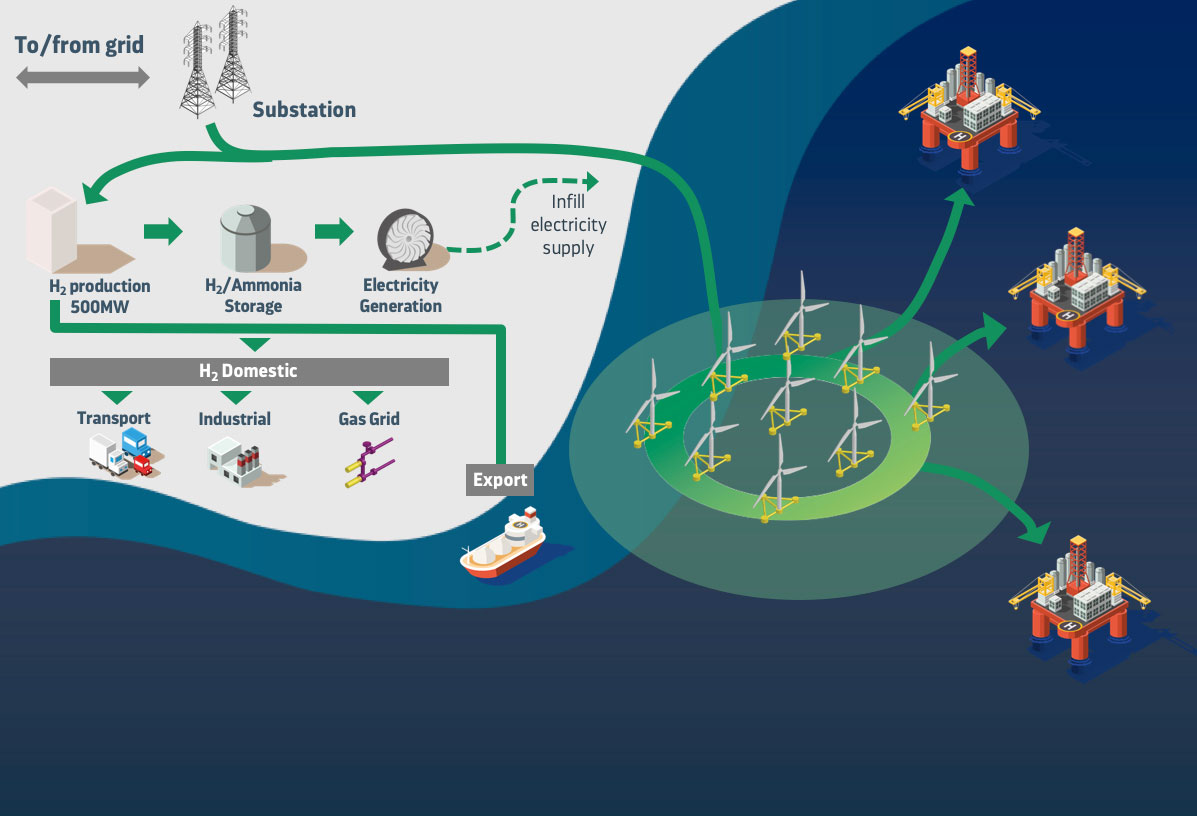

The proposed development involves:

• More than 200 of the largest floating turbines at sites West of Shetland and in the Central North Sea with 3 GW per hour of capacity, feeding power to the offshore facilities and excess 1.5 GW per hour power to onshore green hydrogen plants.

• Ability to electrify the majority of current UKCS assets as well as future production potential from 2024 to reduce emissions well ahead of abatement targets.

• 100 percent availability of green power to offshore platforms at a price below current gas turbine generation through a self-sustained scheme with no upfront cost to operators.

• The development of green hydrogen at scale and £1 billion hydrogen export potential.

• No subsidies or CFD requirements and hundreds of millions of pounds to government revenue via leases and taxation through to 2030.

Cerulean has undertaken the necessary infrastructure planning for the project to ensure the required level of project readiness, targeting financial close in Q1 2022. Construction would start soon after with energization beginning in 2024. An infrastructure project finance model, commonly used for major capital projects is being adopted.

Société Générale, one of the leading European financial services groups, is advising Cerulean Winds.

“The Cerulean UKCS decarbonization project has the potential to meet all of the basin’s transition needs by reducing oil and gas emissions as quickly as possible whilst also introducing large scale green energy,” said Allan Baker, Global Head of Power Advisory and Project Finance. “We are pleased to be supporting the leadership on what is a transformational proposition for the U.K.”

Corporate finance advisers to the energy industry Piper Sandler are also advising.

“The Piper Sandler investment bankers in the U.K. and in the U.S. have partnered with Cerulean’s leadership over the last year to develop the UKCS decarbonization model, and we are pleased that it is now at the regulatory approval stage,” said Tim Hoover, managing director, Project Finance Investment Banking at Piper Sandler. “It is a scheme that understands the needs and requirements of the financial markets to make it bankable.”

Cerulean estimates the current 160,000 oil and gas jobs can be safeguarded, and 200,000 new roles within the floating wind and hydrogen sectors will be created within the next five years.

“We have a transformative development that will give the U.K. the opportunity to rapidly decarbonize oil and gas assets, safeguard many thousands of jobs, and support a new green hydrogen supply chain,” Jackson said. “The decision to proceed with the scheme will ultimately rest with the Scottish government and Marine Scotland and their enthusiasm for a streamlined regulatory approach. The ask is simply that an exceptional decision is made for an extraordinary outcome. We are ready to deliver a self-sustained development that will decarbonize the UKCS and be the single biggest emissions abatement project to date.”

More info: ceruleanwinds.com