Last month, the Biden administration set out new streamlined regulation for offshore wind development as it chases its highly ambitious installation target of 30 GW by 2030.

In the first major regulatory shakeup since 2009, the U.S. Interior Department will offer more flexibility on survey requirements, reform lease auctions, and improve the verification of project designs, it said.

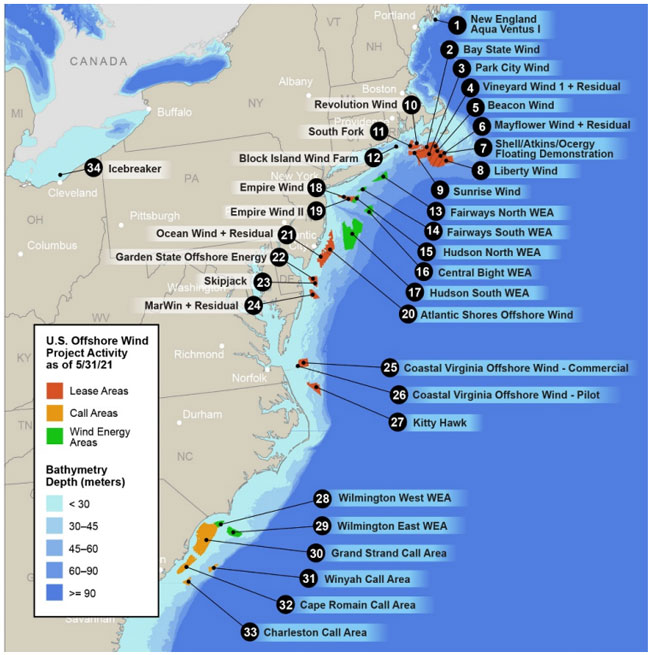

The new rules come as the Interior Department plans to hold up to four additional offshore lease sales by 2025 and aims to complete environmental reviews of at least 16 offshore wind projects by 2025, representing more than 20 GW of new capacity.

Subject to 60-day public consultation, the rule changes represent a “very big package of important incremental improvements” that is “long overdue,” Seth Kaplan, Director of Governmental and Regulatory Affairs at Ocean Winds North America, told Reuters Events.

In particular, more flexibility on surveys in construction and operations plans (COPs) will simplify the permitting and approval process.

In particular, more flexibility on surveys in construction and operations plans (COPs) will simplify the permitting and approval process.

“The new rule adds flexibility in the timing of data submittal, which saves costs, and enables developers to do fewer unnecessary surveys, said Josh Kaplowitz, vice president of Offshore Wind at the American Clean Power (ACP) association.

The Interior Department will also clarify leasing criteria and release five-year leasing roadmaps, providing investors with much-needed certainty.

The rule improvements “will provide the necessary predictability to grow the domestic clean energy economy,” Joris Veldhoven, CEO of Atlantic Shores Offshore Wind, told Reuters Events.

The rule changes “give the industry certainty moving forward,” an Equinor spokesperson said.

Under the proposals, developers will be allowed to submit a range of design parameters in their construction and operations plan (COP) and defer certain survey requirements until later in the development process.

This new approach is less prescriptive and more similar to the project design envelope (PDE) process used in Europe and would give developers greater flexibility to tweak their designs and incorporate the latest technology before installation begins.

Developers could install larger, more efficient turbines “without having to restart the process, so long as you were approved to use a larger model,” Kaplowitz said. Suppliers continue to release higher capacity turbines as developers seek a lower cost per megawatt.

The approval of Vineyard Wind, the U.S.’ first large offshore wind project, was delayed when BOEM expanded the scope of the environmental review to take into account larger turbine considerations, previously unavailable fishing data, a new transit lane alternative, and cumulative risks from multiple offshore wind projects. The environmental review took three years to complete and the 800-MW project is due online in Massachusetts waters in 2024.

The new rules also remove the requirement for site assessment plans (SAPs) for meteorological buoys, providing further savings for developers.

Developers will also be allowed to pay the cost of decommissioning the asset at the end of its life incrementally over the lease term, rather than upfront as required currently, which will create significant savings over the life of the project.

BOEM estimates that the new rules will save U.S. offshore wind developers $1 billion over 20 years, mostly due to the change to decommissioning funding.

The rule changes will help clarify development processes and avoid some delays but the exact impact on project timelines is unclear. Approval processes will remain rigorous and can involve around a dozen federal agencies, industry sources said.

More specific timelines within the rules would help developers plan resources, Kaplowitz said.

“Adding these timelines could be very helpful in terms of making the length of the process more predictable,” he said.

More info: www.reutersevents.com/renewables/wind