Steel is a major component of renewable energy, yet, despite technologies existing for production to be decarbonized, the steel sector is currently responsible for 7 to 8 percent of carbon emissions each year. This figure is projected to rise in line with increasing demand. If we hope to hit Intergovernmental Panel on Climate Change (IPCC) targets for emissions in 2030 and 2050, we must decarbonize the world’s most widely used material, which is steel.

Globally, 80 to 90 percent of steel is recycled to produce secondary steel, but we still need to push that number higher. Preparing secondary steel is three times less carbon intensive than producing primary steel from iron ore. Unfortunately, only 30 percent of global steel consumption annually can be met by recycling/secondary steel. That leaves 70 percent of steel needing to be created through iron ore, which is a highly energy intensive process currently dominated by fossil fuel use. While using renewable energy to produce secondary steel will help progress companies through interim goals, full decarbonization in the industry will rely heavily on reducing carbon emissions from producing primary steel.

Climate Group, in partnership with ResponsibleSteel, is driving the transition to a net zero steel industry by bringing together leading organizations through SteelZero. This initiative brings together forward-looking, demand-side businesses, harnessing their collective purchasing power and influence to shift markets and policies toward the responsible production of steel.

SteelZero members commit to use, procure, or specify 100 percent net-zero steel by 2050 and to use 50 percent low-carbon steel by 2030, setting a roadmap and clear ambition for companies to meet their 100 percent target. This is a first of its kind initiative that engages companies at every step of the supply chain to drive the demand for net-zero steel. From architects to designers to stockholders and contractors, SteelZero works with companies across the renewable energy, automotive, and construction sectors.

SKF — a company well known for solutions to help enable clean technology such as wind power — has made this commitment demonstrating its ambition to tackle the climate crisis through its supply chains. While reaching net-zero steel requires individual companies to take action and examine their own processes and supply/value chains, the transition of global steel production to net zero is a massive undertaking that cannot be achieved without a collaborative effort.

The Business Case for Decarbonizing Steel

Eliminating carbon emissions and transitioning to net zero presents several opportunities. Taking action now enables companies to prepare for the inevitable changes across supply chains and to remain economically competitive in a low-carbon world. A recent report by CDP estimates that 14 percent of steel companies’ potential value is at risk if they’re unable to decrease their environmental impact, and investors are already raising concerns that the steel industry needs to act now to safeguard its future. In doing so, companies can engage with policy makers to address any barriers to achieving net-zero targets, especially in more challenging markets.

Making a public commitment through initiatives such as SteelZero allows companies to create a clear climate strategy, driving change from the inside out. This can then be incorporated into a wider environmental, social, and governance (ESG) strategy, signaling to stakeholders and customers that the company is committed to addressing global issues.

Making a public commitment through initiatives such as SteelZero allows companies to create a clear climate strategy, driving change from the inside out. This can then be incorporated into a wider environmental, social, and governance (ESG) strategy, signaling to stakeholders and customers that the company is committed to addressing global issues.

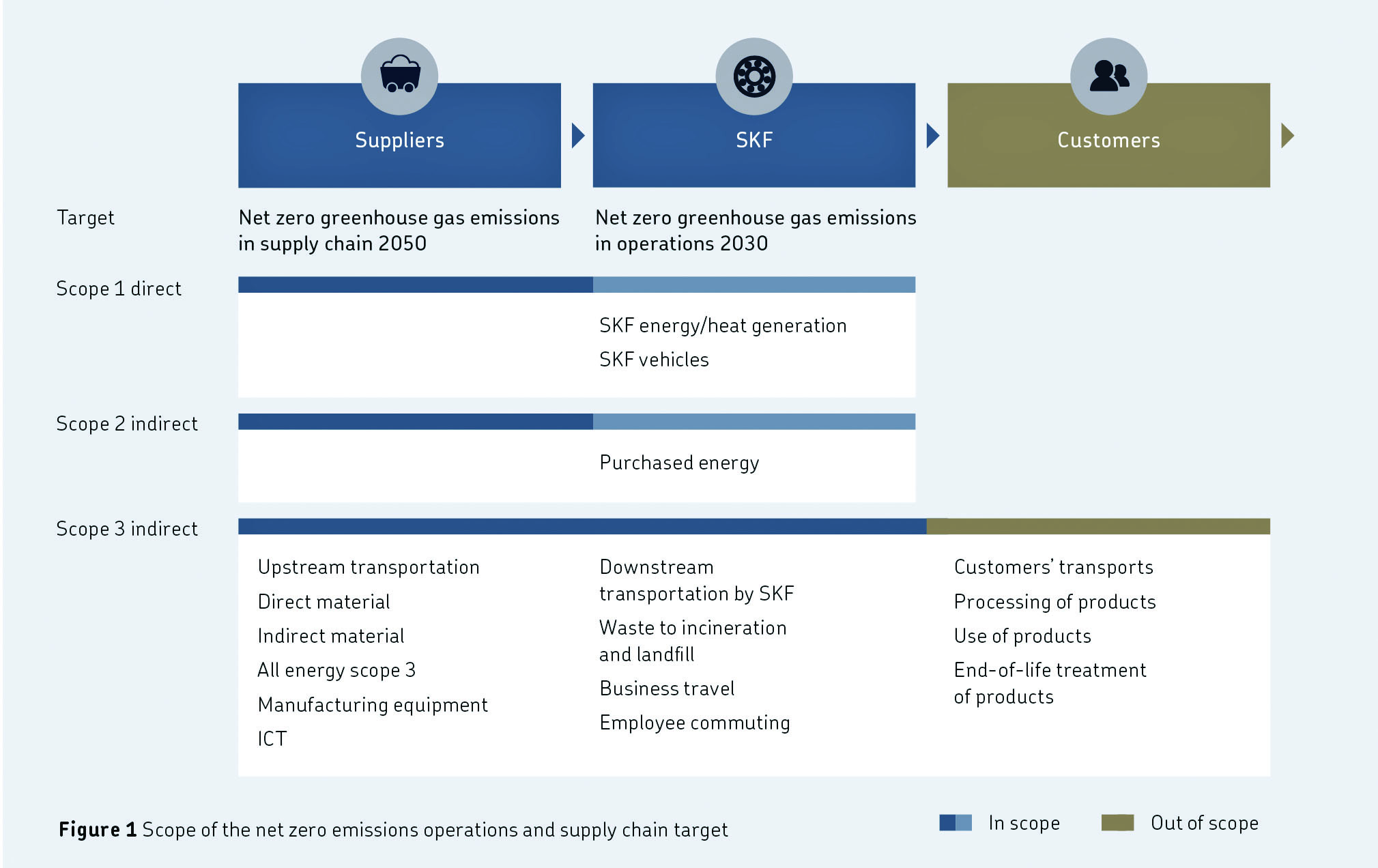

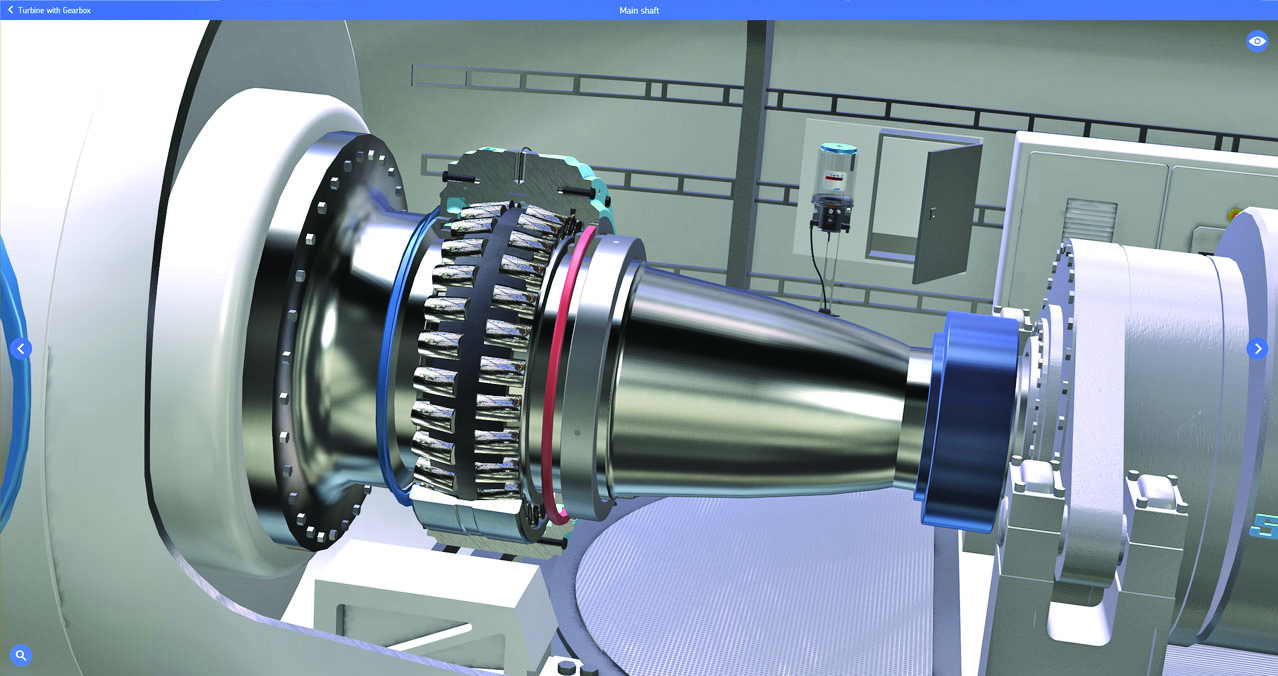

Some forward-looking customers are already asking about the amount of embodied CO2 in suppliers’ products as a key part of deciding with which suppliers to source business. There is a commercial imperative to understand these environmental impacts and figure out how to systematically reduce them. A broad approach that includes the entire supply chain is needed, as there is a daunting amount of enabling infrastructure that needs to be transformed. (See Figure 1)

First and foremost, businesses need to understand what their scope 1, 2, and 3 emissions look like and design a decarbonization roadmap and strategy identifying priorities and actions needed. Once scope 1 and 2 emissions are in order, then it’s time to focus on scope 3 emissions and how a business interacts with the wider business ecosystem. This is where many businesses will come into SteelZero.

SKF: Committing to Upstream and Downstream Sustainability

By breaking down goals into five-year interim targets for each category, SKF can adapt and increase the ambition level of its targets as new technology and government policy evolve. Even if the pathway to zero for a specific sub-target is not fully defined, the company is committed to finding viable options to achieve them through direct means, advocacy, or a combination of both.

SKF’s 2030 goal for its own operations will be achieved by improving energy and material efficiency and by switching to 100-percent renewable energy. The company has direct influence and control on these matters and has experience measuring, reporting, and acting on its own carbon emissions for more than 20 years. But getting SKF factories to net zero by 2030 covers a relatively small part of their overall carbon footprint. To have a serious approach, they needed targets that addressed all of the extended value chain — from raw-material extraction to finished product delivered to the customer — to get to net zero.

It’s essential to not just look at the operations you have direct control over but also to understand the impacts upstream and downstream and reduce those, while avoiding unintended negative trade-offs. From a commercial perspective, not knowing what your CO2 footprint is upstream is quite dangerous because the costs associated with carbon and energy pricing will become more significant in the next few years. Businesses need to be informed and be ahead of those risks and costs to be able to be adapt and extend their competitive advantage in the market.

SKF knows from numerous product carbon-footprint studies that the embodied carbon in the steel materials and components it buys represents between 60 percent to 90 percent of the total emissions generated in its value chain. For SKF, it made sense to prioritize decarbonizing the upstream value chain for steel.

Steel is SKF’s primary raw material (446,000 tons purchased in 2020), and the company estimates that across scope 1, 2, and 3 (upstream) emissions it emits about 1.8 million tons of CO2 per year. The largest percentage is caused by sourcing direct material (primarily steel and steel components), followed by emissions from its own operations and logistics. Even though these numbers sound big, SKF is a relatively small industrial user of steel globally, so it is important to continue to grow the group of companies making these important commitments.

SKF saw an opportunity to have more influence by joining forces with other like-minded users of steel through SteelZero and Responsible Steel. Through this initiative, they now advocate with the industry, regulators, and other stakeholders for short-, medium-, and long-term changes that will drive the transition to net zero. SteelZero, which is led by The Climate Group in partnership with Responsible Steel, drew them in particularly because the breadth of the initiative includes examining the full environmental, social, and governance issues — such as human rights, water, and biodiversity impacts — associated with mining and steel production.

With a projected cost of several trillion U.S. dollars over the next few decades to make this massive transformation in the steel industry happen, the whole value chain has to decide how to absorb the incremental costs. Some of these challenges will be solved by regulation and carbon pricing, but there will also need to be honest discussions within the value chain to achieve net zero goals at each company and across the industry.

Moving the Wind Industry to Net Zero Steel

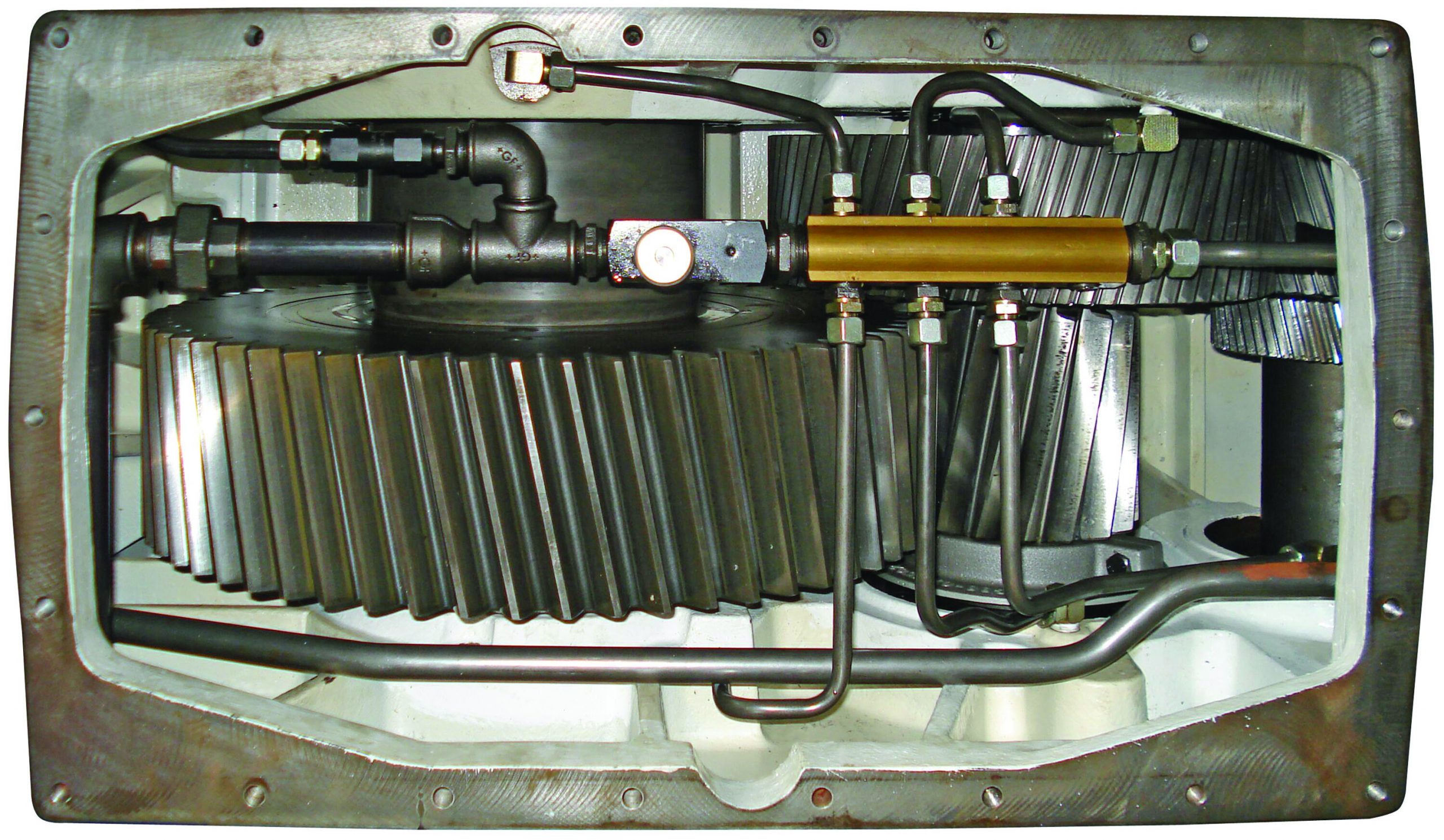

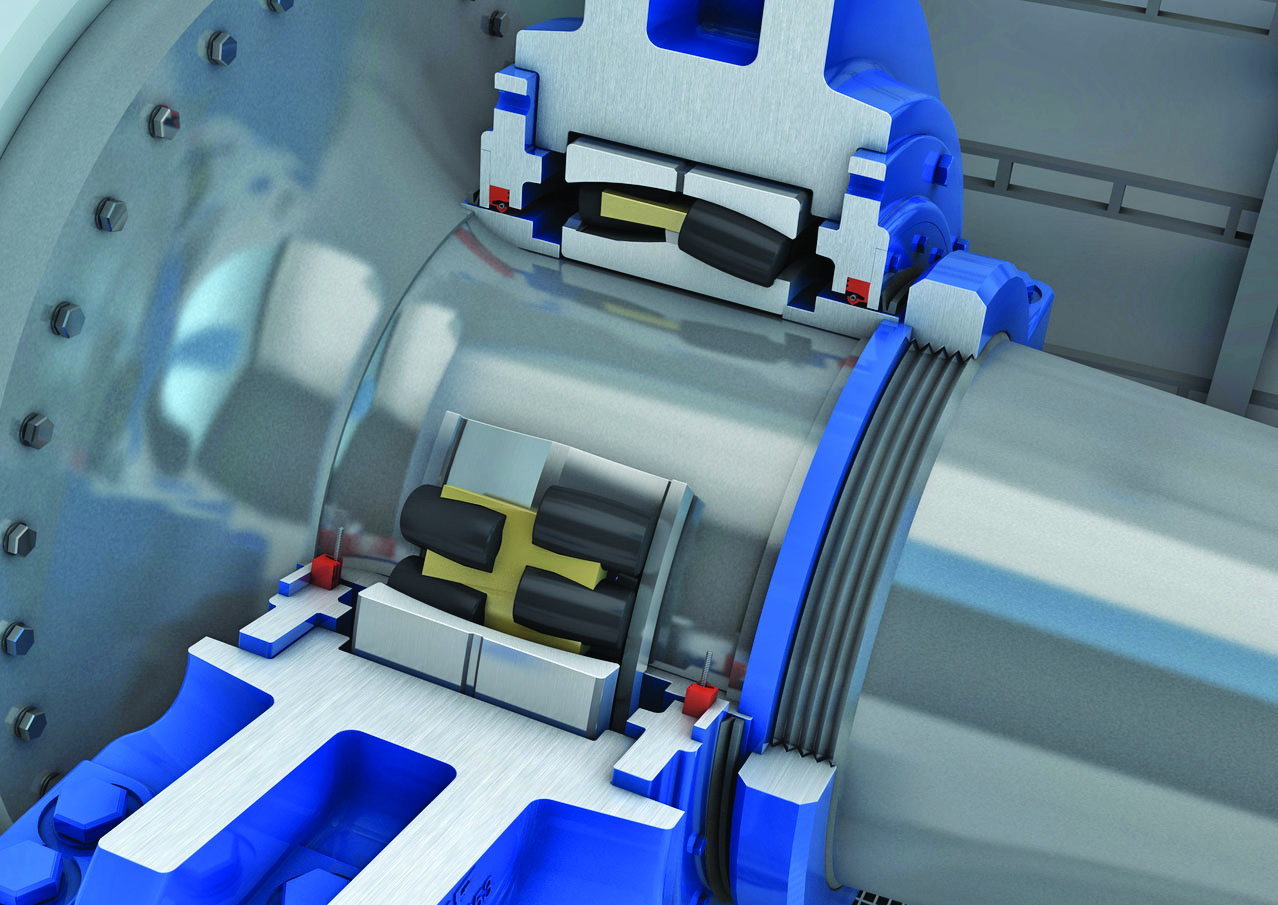

Critics say when a wind turbine is built, the carbon debt takes some years to be repaid because of the amount of CO2 it takes to construct, transport, and erect the turbine. But this is a prevalent criticism that’s simply not true. In most cases, it’s actually a matter of months before the wind turbine pays that energy and carbon back. Because production and shipping of steel is so energy intense, more responsibly sourced steel can play a big role in reducing that time even further. Many companies investing in wind farms want to fully understand what the carbon load is. As a component supplier of bearings, lubrication, and seals to this industry, SKF has found that being able to make products with much less CO2 helps reduce their customers’ carbon footprint as well.

For most industries, as they move toward electrification and as electricity becomes less carbon intensive, the use phase (when machines or processes are running) will be less significant in terms of carbon impact, so they will start to look upstream. But for the wind industry, the biggest challenge to reduce its carbon footprint has always been upstream.

As a supplier, SKF not only aims to transition to a carbon-neutral supply chain but to continue to drive the emissions from its own operations to zero by 2030. For example, the SKF factory in Gothenburg, Sweden, which produces and supplies a huge volume of bearings to the wind industry worldwide, is one of three of the company’s factories already operating at net-zero emissions for scope 1 and 2. SKF also wants to engage manufacturers more in the conversation and share knowledge from its own experiences and from wider engagement with SteelZero members.

Acting Today to Move Toward Net Zero Steel

One of the reasons people at SKF are proud of being part of the SteelZero initiative and committing to these bold targets is because the company built the business and environmental case thoroughly across the organization. As your company starts this process, the data you collect from across your operations and the lifecycle will help you understand where the biggest impacts to your CO2 footprint are. The calculations, analysis, and building of the business case should all be done within a cross-functional and cross-departmental team.

Likewise, your sustainability team or procurement team, for example, should not be alone in deciding to address scope 3 emissions through initiatives like SteelZero. Bring everyone associated with the whole value chain together (strategy makers, R&D, designers, sales, procurement, etc.) and get their understanding and agreement. That way you achieve the organizational buy-in needed to make it happen. A commitment to a net-zero supply chain, and sustainability overall, requires an enterprise approach and alignment across functions for success. The stakes have never been higher, and industrial companies must act to preserve the environment for future generations.