The August 29 federal auction of Wind Energy Areas (WEAs) in the Gulf of Mexico marked the first major opportunity for offshore wind developers to plant their flag in this high-potential region.

The three lease areas totaled roughly 301,746 developable acres, enough to support 3.7 GW of offshore wind generation, an amount that would deliver reliable clean energy to the region’s overburdened grid, not to mention bring new jobs and economic activity to the Gulf and invigorate decarbonization efforts.

However, the full potential of the Gulf goes beyond the positive outcomes listed above. Investing in renewable energy in this region — the heart of the country’s oil and gas industry — is the spark that can ignite a wave of offshore wind industry innovation.

Supply Chain Strengths

Gulf companies have long been recognized for their ability to develop and adapt to new technologies through the booms and busts of the offshore oil sector. And already, many of those companies are turning their attention to the offshore wind industry as they recognize the value of their expertise in this new arena. According to Network research, 23 percent of offshore wind contracts in the U.S. market are already going to Gulf firms, and more than $1 billion in investments are flowing to Gulf shipyards or fabrication yards.

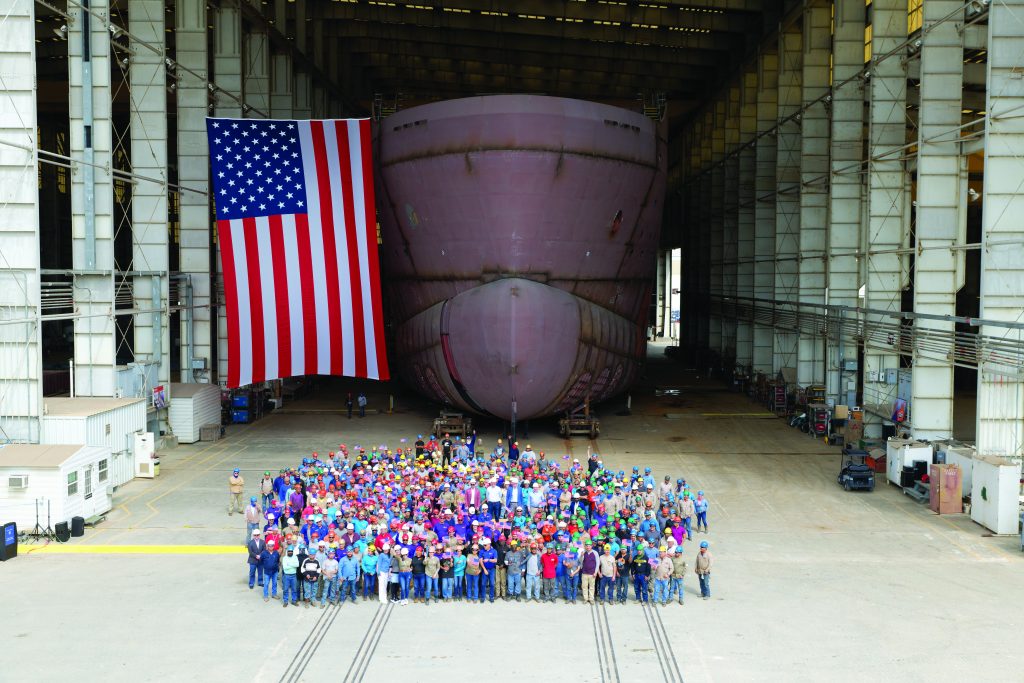

Take the ECO Edison for example, the first American-built Service Operation Vessel for offshore wind, which is under construction by Edison Chouest in Houma, Louisiana, but will later be based out of New York. In Texas, the first U.S.-made offshore substation was built by Kiewit Offshore Services near Corpus Christi, Texas, and, this summer, was transported and installed in New York’s South Fork Wind project, one of the first utility-scale farms to get underway in U.S. waters. Still to come, the first U.S. Wind Turbine Installation Vessel, one of the rarest vessels worldwide, is also underway at the Keppel AmFELS shipyard in Brownsville, Texas.

Notably, the Gulf is already home to a significant portion of the country’s overall vessel construction and maintenance operations. In the future, the region could also become a testing site for alternative fuels and other decarbonization work, including using renewable sources to power oil and gas rigs.

Overcoming Challenges

Of course, challenges to developing offshore wind in the Gulf do exist. Developers will have to contend with both lower-than-average wind speed environments and hurricane-force winds, and any new projects must work around existing offshore infrastructure in the region. Finally, a clear path for offtake and grid connection in Louisiana and Texas must be established before any projects are able to get underway.

Despite such barriers, interest from developers and OEMs in the Gulf was apparent even before the August auction. The Final Sale Notice from the Bureau of Ocean Energy Management identified 14 potential bidders that qualified to participate, less than other recent auctions, but still a significant amount of interest given the region’s challenges.

As Power Advisory President John Dalton shared in an August LinkedIn post prior to the auction, “clearly the GOM isn’t for everyone.”

“Success in the GOM auction is likely to be determined by those that can unlock value in an uncertain market, have a natural hedge, or are able to be patient as market opportunities develop,” he predicted.

WEA Options

With the first lease sale complete, attention is now being paid to the other WEA options that were not included in the initial round. By identifying future sites in advance, BOEM has created the opportunity for a more regular, annual cadence of offshore wind leasing in the Gulf. Such an approach would generate greater confidence within the supply chain that there are more opportunities still to come.

Regardless of how future leasing in the Gulf pans out, companies in the region have already shown that they don’t want to miss out on the new business potential that comes with the offshore wind industry. The Business Network for Offshore Wind has highlighted some of those firms and explored the topic of offshore wind development in the Gulf at length in a new report, “Unlocking the Gulf of Mexico’s Offshore Wind Energy Potential.” The report was published in August and is available to the public at offshorewindus.org.

Editor’s Note

The Aug. 29 auction mentioned in this article had not yet taken place as of press time. An updated version with information about the results of the sale is available at windsystemsmag.com.