As the United States’ burgeoning offshore wind industry has dominated headlines and begun putting steel in the water along the Eastern seaboard, it has done so thanks in no small part to the equipment, know-how, and experience of the oil and gas services industries throughout the Gulf Coast. Just as the Cajun Mariners helped develop the modern offshore oil and gas industry [1] in the Gulf of Mexico as we currently know it, the next generation of Cajun, Texan, and other Gulf Coastal marine, oil and gas service companies have already begun applying their skills and experience to building a new renewable American energy industry in offshore wind. And those same companies are on the brink of many new opportunities as the traditional vents de carême (literally “Lenten winds,” a Cajun French term for “strong spring winds” typically prevalent in the weeks before Easter in southeast Louisiana) in the Gulf of Mexico are poised to become part of that new wind economy.

And while preparing for the imminent rise of offshore wind in the Gulf, Gulf Coast oil and gas service companies — along with the banks and engineering/consulting firms that have supported oil and gas projects in the petroleum energy economy — can take immediate advantage of their unique experience and skillsets to become part of the expanding (and increasingly critical) offshore wind supply chain necessary to meet U.S. renewable energy goals.

Fair Winds and Following Seas:

- Federal Support for a Domestic

- Offshore Wind Industry

Offshore wind has been a huge focus of the Biden administration, from both a policy and fiscal standpoint. The administration has put a goal in place of 30 GW of offshore wind power by 2030. [2] As to be expected with what is essentially a “startup” industry (at least in the U.S.), opinions are mixed as to whether this goal is feasible, given current permitting, supply chain, and workforce challenges [3]; but most agree that even if it is a “stretch” goal, it is achievable with the right governmental support at the federal and state levels, and with market ingenuity. [4] This renewed focus on building a domestic renewable wind industry is a marked change from the Trump administration, during which offshore wind efforts had essentially been stalled. [5]

To back up this ambitious goal, the Biden administration has bulked up the regulatory agency (Bureau of Ocean Energy Management, BOEM) that issues federal leases and permits for offshore wind farms. [6] Likewise, the administration recently revitalized the Federal Permitting Improvement Steering Council (FPISC), a little-known federal agency (whose budgetary authorization had been set to expire in December of 2021) that fosters inter-agency coordination across the broad spectrum of federal agencies necessarily involved in the offshore wind permitting process (BOEM, National Oceanic and Atmospheric Administration, U.S. Army Corps of Engineers, U.S. Coast Guard, and others). [7] The FPISC will be focused on ensuring a clear, efficient, and speedy path to final permitting for offshore wind-project developers, which will (theoretically) in turn allow those developers to provide more certainty and predictability in their downstream contracts with suppliers and OEMs. Likewise, the Biden administration budgeted an 86 percent increase for the Wind Energy Technologies Office (WETO) within the Department of Energy to facilitate R&D for scaling up the offshore wind infrastructure. [8]

Steel in the Water: Current Status of Domestic Offshore Wind Projects

In the midst of all this activity, the largest permitted project to date — Vineyard Wind off the coast of Massachusetts, being developed by Avangrid Renewables and Copenhagen Infrastructure Partners — has commenced onshore construction and will begin offshore construction/installation next spring. Vineyard Wind took essentially four years to work through the permitting process (and six years total from lease sale), a pace that would not allow for the “30 by 30” goal to be reached.

That said, under the Biden administration’s bulked-up BOEM and other wind-centric agency improvements, the process for future projects is expected to go more quickly (but could still take at least two years [9]). The following provides a fairly broad 80,000-foot summary of where things currently stand in terms of the offshore wind pipeline:

Two major … projects with about 940 MW of capacity have reached [final investment decision] and have commenced onshore construction, more than 15 GW of projects are undergoing federal permitting review, 17.5 GW of project capacity has secured offtake commitments from states, auctions containing 12-to-16 GW of potential will be concluded before the end of this year, longer term leasing plans for the Gulf of Mexico, the Central Atlantic, Oregon, and the Gulf of Maine are being developed for auctions before the end of 2024, turbine component, foundation, and cable factories and Jones Act wind-farm vessels are being built in the U.S. and offshore wind port development is accelerating. — www.oedigital.com/news/495870-what-to-expect-from-the-us-offshore-wind-market-this-year

As things stand, offshore wind on the East Coast is a tangible reality, primarily because the Atlantic coast has the best/most consistent wind closest to population centers that can off-take the power. To this end, the Biden administration very recently announced an Eastern seaboard federal/state partnership in support of building out offshore wind infrastructure and economies: “Eleven leading states along the East Coast will participate in this new partnership, a first-of-its-kind forum for collaboration between federal and state officials to accelerate offshore wind progress.” [10]

New Horizons: Offshore Wind in the Gulf of Mexico and Pacific Coast for Grid Transmission and Beyond

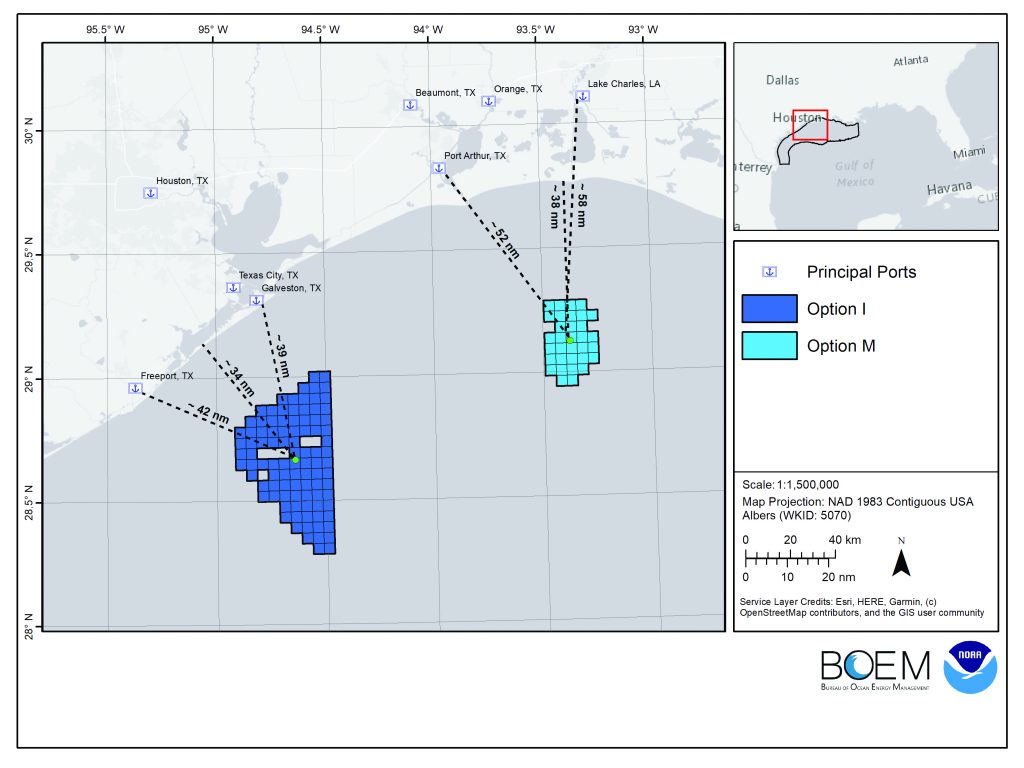

But as sure as the annual “Lenten Winds,” offshore wind in the Gulf of Mexico (GOM) and the West Coast is coming, with the first GOM lease sale (from among 11 BOEM-designated wind lease areas [11]) tentatively scheduled for early 2023. BOEM recently announced (on July 20, 2022) the first two draft wind-energy areas (WEAs) off the coasts of Galveston, Texas, and Lake Charles, Louisiana, which combined have the potential to power more than 3 million homes. [12] These first two draft WEAs have been culled down from the original 30-million-acre GOM “call area” originally identified in October 2021, based on BOEM review of data for avoidance of conflicts with other ocean uses (i.e., commercial/recreational fishing, maritime navigation, existing offshore infrastructure, military activities, and protected marine/avian species). [13]

The two draft WEAs will be subject to public comment period, which was scheduled to close on August 20, 2022. A similar process is underway for lease-area-identification and sale processes for the West Coast, with the anticipated West Coast lease sale to follow in 2023. [14]

Likewise, the recently passed Inflation Reduction Act, the highly touted keystone legislation supporting the Biden administration’s “Build Back Better” theme, includes numerous tax credits and financial incentives intended to “supercharge” offshore/renewable wind development in the United States, including in the GOM and West Coast, by incentivizing investment in offshore wind development projects as well as in manufacturing of offshore wind components and infrastructure, including support/installation vessels, to create a robust and efficient domestic supply chain. [15]

However, there are only a few areas of the GOM with sufficient quality/consistency of wind to support direct wind-to-grid operations, and the West Coast will require floating infrastructure (not bottom-fixed infrastructure) due to the near-shore depths on the Pacific shelf. Floating wind turbines have been deployed on a limited scale in Europe, but not at grid-scale (although the technology for floating is rapidly advancing). Nonetheless, the state of California has formally made offshore wind development a line-item priority pursuant to a legislative edict fleshed out by a recently issued plan by the California Energy Commission, which focus on floating infrastructure and anticipated fast ramp-up of floating technologies. [16]

Further, another potential alternative use for wind energy in the GOM would be to power offshore carbon sequestration — i.e., to provide on-site, on-demand offshore electricity, without requiring extensive transmission infrastructure and/or taxing onshore grids servicing population centers, to power compressors that can inject and store under pressure captured carbon in depleted offshore oil and gas well formations. Indeed, this potential alternative use for offshore wind was specifically incorporated into the infrastructure bill passed by Congress and signed by President Biden in late 2021. [17]

Periodic Winds, Periodic Tables: Green Hydrogen in the Gulf of Mexico

Despite what is currently understood as the limited “wind to grid” capacity in the GOM, the shear breadth/square area footprint of the GOM has generated interest in using that relatively expansive geographic scope, which has consistent if not qualitatively sufficient wind for grid-generation purposes, to install smaller wind turbine units — perhaps on existing no-longer-viable oil and gas infrastructure. These smaller but more numerous installations could then be used to generate electricity to power offshore electrolyzers that convert desalinated sea water to liquid hydrogen, which could in turn be shipped via existing oil and gas pipeline infrastructure back to shore for use in myriad potential applications. Green hydrogen in the GOM is, in many analysts’ view, the most imminently viable means of harnessing offshore wind energy in the GOM. [18]

A green hydrogen market could be a huge boon for Louisiana and Texas — and provide new opportunities for the existing oil and gas midstream service sector — given the number of chemical plants, the potential for hydrogen fuel cell truck transportation on the Interstate 10 corridor, redundancy/backup for utility power generation, alternative/renewable fuel for powering marine terminal/port infrastructure and “cold ironing” vessels in port, and use as a marine fuel to meet upcoming maritime carbon emission restrictions as well as investment/market-based ESG initiatives. To this last point, New Orleans-based Maritime Partners, LLC is currently building a proof-of-concept true zero-emission 2000 HP inland pushboat, the HYDROGEN 1, which will be powered by methanol feed/fuel stock, processed via onboard methanol reformers, into liquid hydrogen to run hydrogen-fueled engines. [19]

GOM Coastal States Establish Renewable Energy Task Force, Louisiana State Waters Leasing

The vast potential for renewable wind energy in the GOM (whether via grid generation, green hydrogen, or otherwise) has been recognized by all coastal states with the establishment of the Gulf of Mexico Intergovernmental Renewable Energy Task Force, [20] an effort that was spear-headed by Louisiana Gov. John Bel Edwards’ office in the fall of 2020. The Task Force has held two meetings with BOEM and is actively engaged in making renewable wind energy a reality in the GOM.

Louisiana has further continued to lead the charge toward a wind economy in the GOM, including recently passing state legislation authorizing and establishing a process for installation of wind facilities in state territorial waters (which would potentially allow for speedier permitting than the federal leasing process), all toward Louisiana’s state goal of 5 GW of renewable offshore wind power by 2035. [21] Analysts view this state-water path as a potential incubator for smaller proof-of-concept wind-to-electricity projects, as well as wind-to-green hydrogen. [22] Louisiana Rep. Jerome Zeringue, one of the co-sponsors of the legislation along with Rep. Joe Orgeron, has indicated that he expects the first Louisiana state lease sales (for wind leases in state territorial waters) “should occur in the next 18 months.” [23]

Trade Winds – Private Sector Investments in the Domestic Offshore Wind Market

And the private sector is getting involved as well: In April, Germany-based RWE Renewables (a leading offshore wind developer) entered a formal partnership with GNO, Inc. (the regional economic development nonprofit organization serving the 10-parish region of Southeast Louisiana that includes Jefferson, Orleans, Plaquemines, St. Bernard, St. Charles, St. James, St. John the Baptist, St. Tammany, Tangipahoa, and Washington parishes) “to build a program that will help existing Louisiana companies, especially in oil and gas, participate in the growing national supply chain for offshore wind.” [24]

The goal of the partnership is to conduct outreach to “existing Louisiana companies with transferable capabilities for offshore wind [— f]or example, companies that build oil rig jackets (underwater towers) can do the same for offshore windmills [—]… to provide leading energy companies, like RWE, with viable supply chain contacts to fulfill their need to deploy several gigawatts of offshore wind power.”

Despite all this progress, there remain challenges, and arguably the biggest one facing the U.S. offshore wind industry as a whole is the creation of a viable, sustainable domestic supply chain, from domestic construction of components to logistics to move components — including perhaps most prominently vessels and port/terminal facilities – workforce training, etc. And of course, behind all of this is the need for capitalization, either through market capital or governmental support/incentives or (most likely) some combination of the two.

Loan Guarantee Program for Offshore Wind Technologies

The Biden administration has allocated a tremendous amount of funds to facilitate/encourage offshore wind investment through various modes (direct federal lending support through the Loan Programs Office of the Department of Energy, port/infrastructure grants through the Maritime Administration, dedicated funds/incentives in the Build Back Better bill, etc.). As specific examples, the Department of Energy’s 2023 budget for FY 23 has allocated nearly $350 million earmarked for development of wind technologies. [25]

Likewise, the DOE’s Loan Guarantee Program has access to $3 billion in loan guarantee capacity specifically for offshore wind technologies, including potentially supply chain and vessel construction support. [26] Additionally, the Maritime Administration (MARAD) has recently announced that financing of offshore wind installation/support vessels will be a priority under its Title XI vessel finance mechanism, with approximately $475 million in capacity for construction guarantees under the program. [27] Further, in its most recent and upcoming lease sales, BOEM has been offering a 20 percent credit/rebate to successful bidders contingent on reinvestment of those funds into workforce development, vessel construction, and supply chain buildout. [28]

In addition to — and perhaps because of — these government efforts, the private/market sectors have also begun investing heavily in offshore wind. For example, the recent New York Bight federal lease sale resulted in the lease of 488,000 acres for a total of $4.37 billion. [29] And the most recent lease sale of North Carolina brought winning bids totaling $315 million. [30]

Domestic Supply Chain

As noted above, two of the most critical potential bottleneck areas in the domestic supply chain for offshore wind are port infrastructure and specialized vessel availability. The East Coast projects in particular have struggled to source sufficient port space (or even space available to expand existing ports) – i.e., “lay down” areas – to accommodate the extremely large offshore wind-farm components (blades, nacelles, and monopile structures). [31] As a result, much of the current mobilization has relied heavily either on direct trans-Atlantic mobilization from European manufacturers, or from Gulf Coast manufacturers/ports (who have experience/expertise in building oil and gas infrastructure components, and the port area to mobilize them). This sometimes results in tension for developers who often have local content requirements in contracts with their East Coast purchasers (utilities who will buy power from the eventual wind farm production). Also, it should be noted that, because most developers are coming from the long-existent European offshore wind industry, they already have efficiencies/economies of scale in place with European component manufacturers, so they are somewhat apprehensive about changing their models to start using untested U.S. manufacturing sources.

As to vessels, under a set of federal laws known as the Jones Act cabotage laws, any vessel that moves materials from a point in the U.S. to a point on the U.S. continental shelf (where most offshore wind farms are located) has to be U.S.-built, U.S.-owned, and U.S.-crewed.

Currently, there are no existing specialized wind-farm construction/installation vessels (although there are a few under construction, mostly with Gulf of Mexico shipyards). The Jones Act/vessel problem is a classic chicken/egg predicament: Developers need the vessels, but aren’t willing to offer long term usage contracts for the vessels, because they (the developers) do not know what the timeframes will be for future wind-farm lease projects. Thus, because the developers are essentially working with one-at-a-time, long-lead projects, they are hesitant to commit to long-term charters/rentals of vessels. In turn vessel owners/operators aren’t willing to invest the capex — or more importantly, cannot convince banks to lend them the necessary capital — to build new vessels without long-term usage contract commitments from the developers. That said, there are an increasing number of these highly specialized vessels (including the largest Wind Turbine Installation Vessels (WTIVs) and Service Operations Vessels (SOVs), and Crew Transfer Vessels (CTVs)) being built in the U.S. to Jones Act compliance specifications. [32]

Further, as was the case with the first U.S. offshore wind farm at Block Island in Rhode Island, developers can deploy a Jones Act compliance feedering solution, whereby Jones Act compliance U.S. vessels (barges, tugs, and jackup vessels) deliver wind-farm components to foreign-flagged vessels offshore for installation. [33]

Lenten Winds: Opportunities to Expand and Diversify Existing Industries

In the end, just as Louisiana’s “Lenten Winds” coincide with spring and new growth, the emerging offshore wind economy promises new opportunities for the Gulf Coast’s existing oil and gas service industries, both at home and on the Atlantic and Pacific coasts. Indeed, the supply chains necessary to build, support and sustain an American offshore wind industry will necessarily be national in scope and will not be sustainable if parochial interests prevail. The expertise and practical know-how developed over decades in the GOM oil and gas service industry is uniquely positioned to seamlessly provide expert, cost-efficient, and efficient/timely support to the wind industry.

The same fabricators who have made oil well jackets can easily retool to fabricate wind turbine monopiles. The oilfield service vessel shipbuilders can build to new wind support specs, and the vessel operators have the crews and administrative staff to operate them. The same ports and terminals across the GOM with the laydown space and equipment to station and transport oilfield project cargos from rig modules to pipeline infrastructure can dedicate those same assets to blades, nacelles and monopiles. And all the upstream industries that have supported the oil and gas energy industry for decades — banks, engineering consultants, logistics experts, etc. — can apply the same skills to the wind-energy industry.

Rather than presenting a challenge for reinvention, wind energy is an opportunity for oil and gas service providers to retool and diversify. And as a result, offshore wind will not (and certainly not in the short term) be a replacement for the existing, and extremely important, oil and gas industry in the Gulf. Rather, the advent of offshore wind in the GOM is better described as an “all-of-the-above” approach, as Rep. Zeringue of Louisiana has described in the context of the recent bill opening Louisiana state waters to wind leasing: “This is going to augment and support the oil service industry — oil and gas industry — that are primed to be able to take advantage of this new technology. I mean, if you can build an oil rig you can build a wind turbine.” [34]

Both “energy” industries — traditional oil and gas and renewable wind — will work (and put people to work) side by side, as Michael Hecht, CEO of Greater New Orleans, Inc. has aptly described: “It’s not an either/or; we think that there’s going to be a portfolio approach, with renewables increasingly part of the mix.” [35]

Questions for Gulf Coast Companies to consider regarding offshore wind supply chain opportunities:

- What phases of the offshore wind supply chain fit your company’s service/expertise profile?

- What presence does your company have in the U.S. offshore wind market/supply chain currently?

- What geographical regions can your company service, either directly or via local partnerships? East Coast? West Coast? Gulf?

- What challenges/questions does your company envision regarding its entry/role into the U.S. wind industry?

- What funding sources/incentives (public and/or private) would be helpful?

- What introductions would be helpful?

- What further information would be helpful to evaluate your company’s potential opportunities in offshore wind?

- What specific answers to specific questions would help your company determine its role in the wind economy, both regionally and nationally?

About the authors

Christopher Hannan is a shareholder in the New Orleans office of Baker Donelson and is a member of the Transportation Group with a focus on the areas of admiralty and maritime law. He can be reached at channan@bakerdonelson.com. Joe Tirone serves as a leader of Baker Donelson’s Energy Transactions Team and as the chair of the Power and Renewable Energy Team. A shareholder in the firm’s Baltimore office, he can be reached at jtirone@bakerdonelson.com.

References

- https://64parishes.org/in-the-wind

- https://www.whitehouse.gov/briefing-room/statements-releases/2021/03/29/fact-sheet-biden-administration-jumpstarts-offshore-wind-energy-projects-to-create-jobs/

- https://www.rechargenews.com/energy-transition/bidens-ambitious-2030-us-offshore-wind-goal-unattainable-due-to-bottlenecks-ihs-markit/2-1-1045650

- https://dailyenergyinsider.com/news/29720-biden-administration-announces-30-gw-offshore-wind-plan/#:~:text=%E2%80%9CThe%20Biden%20Administration%E2%80%99s%20ambitious%2C%20but,Zichal%2C%20CEO%20of%20the%20American

- https://electrek.co/2021/01/26/egeb-first-major-us-offshore-wind-farm-asks-biden-to-restart-permits/

- https://www.natlawreview.com/article/five-things-you-should-know-about-offshore-wind-development-right-now

- https://www.boem.gov/newsroom/press-releases/biden-harris-administration-proposes-key-program-increases-bureau-ocean

- https://news.bloomberglaw.com/environment-and-energy/new-biden-permitting-boss-looks-to-rebuild-interagency-muscle

- https://www.energy.gov/eere/wind/articles/biden-administrations-budget-request-calls-increase-across-wind-energy-research

- https://www.natlawreview.com/article/five-things-you-should-know-about-offshore-wind-development-right-now

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/06/23/fact-sheet-biden-administration-launches-new-federal-state-offshore-wind-partnership-to-grow-american-made-clean-energy/

- https://www.rechargenews.com/wind/first-auctions-next-year-as-us-unveils-lease-bonanza-to-build-16gw-of-offshore-wind-in-gulf/2-1-1207600

- https://doi.gov/pressreleases/department-interior-announces-next-steps-offshore-wind-energy-gulf-mexico

- https://www.boem.gov/renewable-energy/state-activities/gulf-mexico-activities

- https://www.govinfo.gov/content/pkg/FR-2022-05-31/pdf/2022-11537.pdf

- https://crsreports.congress.gov/product/pdf/IN/IN11980

- https://nawindpower.com/senate-passes-inflation-reduction-act-to-advance-clean-energy-deployment

- https://www.energy.ca.gov/publications/2022/offshore-wind-energy-development-california-coast-maximum-feasible-capacity-and

- https://www.huffpost.com/entry/infrastructure-law-carbon-capture-offshore_n_62b4c08ce4b0cdccbe68d51a

- https://www.politico.com/news/2022/05/30/energy-wind-gulf-of-mexico-00035446

- https://www.marinelog.com/inland-coastal/inland/maritime-partners-hosts-hydrogen-event-in-new-orleans/

- https://www.bunkerspot.com/global/56598-interview-fuel-cell-technology-piquing-the-interest-of-larger-operators-says-e1-marine

- https://www.boem.gov/renewable-energy/state-activities/gulf-mexico-gom-intergovernmental-renewable-energy-task-force

- https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/la-governor-signs-bill-creating-framework-for-state-s-1st-offshore-wind-farms-70882032

- https://www.rechargenews.com/wind/offshore-wind-pilots-and-green-h2-louisiana-plots-way-forward-on-us-gulf-energy-journey/2-1-1248521

- https://neworleanscitybusiness.com/blog/2022/08/04/louisiana-updates-offshore-wind-energy-legislation/

- https://gnoinc.org/news/rwe-gno-offshore-supply-chain/

- https://www.energy.gov/sites/default/files/2022-04/doe-fy2023-budget-volume-4.pdf

- https://www.energy.gov/sites/default/files/2021-03/DOE-LPO_Program%20Handout_T17-REEE-Offshore%20Wind_2021-03-26.pdf

- https://www.maritime-executive.com/article/marad-prioritizes-offshore-wind-vessels-for-title-xi-financing

- https://www.govinfo.gov/content/pkg/FR-2022-05-31/pdf/2022-11537.pdf

- https://www.doi.gov/pressreleases/biden-harris-administration-announces-wind-energy-lease-sale-offshore-carolinas

- https://www.boem.gov/renewable-energy/state-activities/new-york-bight

- https://www.doi.gov/pressreleases/biden-harris-administration-announces-winners-carolina-long-bay-offshore-wind-energy

- https://www.mckinsey.com/industries/electric-power-and-natural-gas/our-insights/scaling-the-us-east-coast-offshore-wind-industry-to-20-gigawatts-and-beyond

- https://ww2.eagle.org/content/dam/eagle/publications/cutsheets/offshore-windfarm-support-vessels-cutsheet.pdf

- https://www.tradewindsnews.com/offshore/deme-eyes-jones-act-compliant-feeder-solution-for-us-offshore-wind-farms/2-1-1213075

- https://louisianaradionetwork.com/2022/08/02/new-law-opens-bigger-leases-for-wind-energy-and-sets-up-revenue-share-for-the-state/

- https://64parishes.org/in-the-wind