The success of any big investment, whether you are buying a house or acquiring a wind farm, hinges on thorough due diligence (DD). Nobody dives into a purchase without a solid understanding of what they’re getting themselves into.

Renewables DD requires an intricate interplay between the asset owner, their lenders and investors, and the specialist legal, technical, insurance and financial advisers engaged to assess project risks.

These expert advisers play a pivotal role in giving capital providers the confidence to back vital wind, solar, and storage projects, boasting impressive long-term track records in the sector.

However, the efficiency with which they can impart their hard-won knowledge is hampered by traditional approaches in the DD process, which tend to be time-consuming, resource intensive, and ultimately place an unnecessary burden on their clients.

DD doesn’t need to be this hard — and, as pressure grows to accelerate capacity growth worldwide, it’s clear that now is the time for a “reboot.”

Market forces drive advisers to focus on streamlining due diligence

The surge in demand for renewable energy, driven by a global commitment to sustainability, has fostered significant growth in the sector. As nations and industries transition toward cleaner energy sources, investors are confronted with an expanding array of opportunities.

In the U.S. market, the Inflation Reduction Act (IRA) is driving significant interest, resulting in investor appetite far exceeding the availability of high-quality projects. In the U.S., as is the case globally, there is a pressing need to expedite the capital flow into new projects. This acceleration is crucial to ensure projects move through the pipeline as quickly as possible, ultimately enabling developers to reinvest elsewhere and bring more capacity online.

With increased competition in the market, fueled by the growing attractiveness of sustainable investments, the race to secure high-quality projects has intensified. As ESG considerations intertwine with investment decisions, companies find themselves not only competing for projects based on financial metrics but also on their ability to meet ESG standards, bringing additional intricacies.

Additionally, rapid technological advancements, such as innovations in floating wind, energy storage and green hydrogen, coupled with new financing and offtake structures, demand a DD process that is not only efficient but also capable of keeping pace with the latest industry innovations.

In the dynamic landscape of DD, advisers must focus on putting into operation their unique institutional knowledge to provide swift insights derived from specialist industry expertise. Simultaneously, the demand for faster and earlier insights underscores the importance of effective, more transparent collaboration with clients’ full advisory teams to navigate complex deals and shorter transaction timeframes.

Tackling due diligence bottlenecks

So, how can this be achieved in practice?

Streamlining due diligence will require a concerted effort to identify and address a number of key bottlenecks — but the simple solution lies in bringing together disparate forms of transaction communication and reporting into one place.

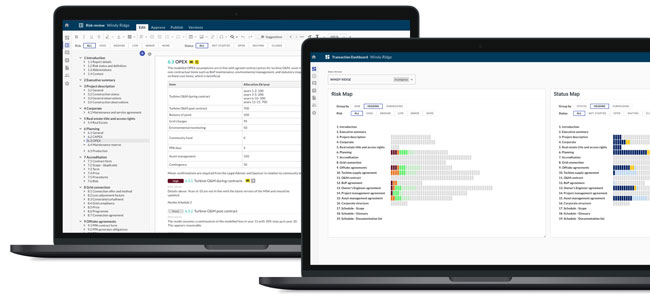

Adoption of modernized reporting practices: Lengthy and intricate reports, often 300-plus pages long, can be replaced with digital tools that allow advisers to provide more timely, manageable updates.

Enhancing communication through collaborative platforms: Real-time communication is needed to foster more seamless inter-adviser cooperation. Utilizing a single platform that brings all advisers under one roof streamlines operations and reduces administrative burdens. By automatically collating systems, this eliminates unwieldy Q&As and reduces the risk of missing critical points.

- Deal visibility: Establishing a centralized platform for monitoring progress and timelines ensures a coordinated workflow. This enables teams to track risks, status and Q&A, and maintain an organized and informed approach throughout the due diligence process.

- Centralizing information: Consolidating all project-critical information into one platform addresses the challenge of fragmented or siloed data, providing a unified, source of truth accessible to involved parties.

- Integration of advanced tools: Incorporating tools serves to streamline routine tasks, enhancing efficiency and accuracy. Gone are the days of lengthy documents compiled from various inputs and disconnected information.

Gaining a competitive edge through better knowledge management

Due-diligence advisers have been grappling for some time with how to use technology to improve their services and move away from outdated and burdensome approaches to DD. While advisers possess significant expertise in assessing the feasibility and risk of projects, there is a significant opportunity for them to enhance their practice by embracing digital solutions. This will ensure that their hard-won knowledge and experience is readily accessible throughout their organizations, contributing to more streamlined and efficient processes and enhanced client offering.

A number of frontrunners are emerging in the race by advisers to put into operation their institutional knowledge. Global law firm DLA Piper and global technical consultancy Wood, are taking a leading role in the “reboot” of due diligence, having recently agreed to long-term deals with LiveDiligence to improve the transaction experience for their clients.

This ensures valuable expertise is not only retained within their organizations but actively put to use in decision-making. There is a pressing need to speed up processes to reduce the lag between renewable-energy project conception and the deployment of investor and lender capital. It’s important to realize this goal can be achieved without compromising the quality of service and insight provided.

A centralized, digitalized DD approach offers the advantage of delivering faster and earlier insights, ultimately reducing the time it takes to reach financial close. In a sector where timely decision making is paramount to speeding up transaction timelines, streamlining due diligence emerges as a strategic necessity to navigate the changing requirements of the modern clean-energy landscape.